Private student loans are a type of loan that can be used to help pay for college costs. They are offered by banks, credit unions, and online lenders. Private student loans typically have higher interest rates than federal student loans, but they may offer some advantages, such as the ability to borrow more money and the option to defer payments while you are in school. private student loan 2023-24

Interest rates for private student loans in 2023

Interest rates for private student loans vary depending on the lender, the borrower’s credit score, and the terms of the loan. In general, borrowers with good credit scores can expect to get lower interest rates than borrowers with poor credit scores.

The average fixed interest rate on a 10-year private student loan for borrowers with a credit score of 720 or higher was 7.30% in August 2023. The average variable interest rate on a 5-year private student loan for the same borrowers was 7.77%.private student loan 2023-24

Eligibility for private student loans

To be eligible for a private student loan, you must meet the lender’s requirements. These requirements typically include a minimum credit score, a minimum income, and a good academic record.

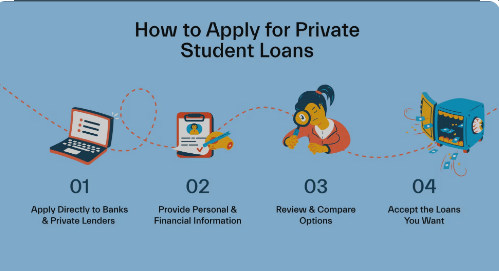

How to apply for a private student loan?

To apply for a private student loan, you will need to provide the lender with your personal information, your financial information, and your academic information. The lender will then review your application and decide whether to approve you for a loan.

Using private student loans wisely

If you are considering taking out a private student loan, it is important to use the loan wisely. Make sure that you only borrow what you need to pay for college costs. And, be sure to repay the loan on time and in full. private student loan 2023-24

Here are some tips for using private student loans wisely:

- Only borrow what you need.

- Shop around for the best interest rate.

- Consider a co-signer if you have bad credit.

- Make sure you understand the terms of the loan.

- Repay the loan on time and in full.

best private student loans

Here are the best private student loans in 40 words:

SoFi: No fees, co-signer release option, and flexible repayment options.

Ascent: Prequalify without a hard credit check, and get a graduation reward of 1% of the loan’s original principal balance.

College Ave: Offers loans for undergraduate, graduate, and parents, and has a six-month grace period extension available.

Citizens: Offers multiyear approval loans, and borrowers can save up to 0.5 of a percentage point for having another Citizens account and setting up autopay.

Sallie Mae: One of the largest private student loan lenders, and offers a short cosigner release period.

student private loans

Student private loans are loans that are offered by private lenders, such as banks, credit unions, and online lenders, to help students pay for college expenses. Unlike federal student loans, which are subsidized by the government, private student loans do not have a fixed interest rate. Instead, the interest rate on a private student loan is based on the borrower’s creditworthiness.

Private student loans can be a good option for students who need to borrow more money than they can get in federal student loans. However, it is important to shop around and compare interest rates before taking out a private student loan. Students should also be aware of the terms and conditions of the loan, including the repayment schedule and any fees that may be charged.

Private student loans without consigner

Private student loans without a cosigner can be a great option for students who do not have a cosigner or who have poor credit. However, these loans typically have higher interest rates than loans with a cosigner.

Here are some of the best private student loans without a cosigner:

- Ascent: Offers loans for undergraduate and graduate students, with fixed or variable interest rates.

- Earnest: Offers loans for undergraduate and graduate students, with fixed or variable interest rates.

- SoFi: Offers loans for undergraduate and graduate students, with fixed or variable interest rates.

- Wells Fargo: Offers loans for undergraduate and graduate students, with fixed or variable interest rates.

- Citizens Bank: Offers loans for undergraduate and graduate students, with fixed or variable interest rates.

When comparing private student loans without a cosigner, it is important to consider the following factors:

- Interest rate: The interest rate is the most important factor to consider when choosing a private student loan.

- Repayment terms: The repayment terms, such as the repayment period and grace period, will affect how much you will pay in interest over the life of the loan.

- Fees: Some lenders charge fees for private student loans, so be sure to compare the fees before you choose a loan.

- Credit requirements: The credit requirements for private student loans without a cosigner vary by lender. Some lenders may require a minimum credit score, while others may consider other factors, such as your income and academic record.

It is also important to compare private student loans with federal student loans. Federal student loans typically have lower interest rates and more borrower protections than private student loans.

What are private student loans?

Private student loans are loans that are offered by banks, credit unions, and online lenders. They can be used to help pay for college costs, such as tuition, fees, room and board, and books.

private student loan relief

Private student loan relief refers to a variety of programs and benefits that can help borrowers repay their private student loans. These programs can include:

- Repayment plans: These plans can extend the term of the loan, lower the monthly payment, or both.

- Forgiveness programs: These programs can cancel all or some of the borrower’s debt.

- Deferment and forbearance: These programs can allow the borrower to postpone their payments for a period of time.

The specific programs and benefits available to borrowers will vary depending on their individual circumstances. Some programs may be based on the borrower’s income, others on their type of loan, and still others on their career path.

What are the benefits of private student loans?

There are several benefits to taking out a private student loan, including:

- The ability to borrow more money than you could with federal student loans.

- The option to defer payments while you are in school.

- The ability to choose a repayment term that fits your budget.

What are the drawbacks of private student loans?

Private student loans typically have higher interest rates than federal student loans. They also may not offer the same borrower protections as federal student loans.

How do I qualify for a private student loan?

The eligibility requirements for private student loans vary by lender. However, most lenders will require you to meet the following criteria:

- Be a U.S. citizen or permanent resident.

- Be at least 18 years old.

- Have a good credit score.

- Be enrolled in a full-time undergraduate or graduate program.

How do I use private student loans wisely?

If you are considering taking out a private student loan, it is important to use the loan wisely. Here are some tips for using private student loans wisely:

- Only borrow what you need.

- Shop around for the best interest rate.

- Consider a co-signer if you have bad credit.

- Make sure you understand the terms of the loan.

- Repay the loan on time and in full.

What are the alternatives to private student loans?

There are several alternatives to private student loans, including:

- Federal student loans.

- Scholarships.

- Grants.

- Work-study.

- Personal loans.

Additional resources

Official websites for Private Loans:

- Federal Student Aid: https://studentaid.gov/

- Credible.com: https://www.credible.com/student-loans/

- Navient: https://www.navient.com/

- Sallie Mae: https://www.salliemae.com/